September 2021 is a Seller's market!

The number of for sale listings was down 100% from one year earlier and down 100% from the previous month. The numberof sold listings decreased 22.2% year over year and increased 133.3% month over month. The number of under contract listings was up 83.3% compared toprevious month and down 15.4% compared to previous year. The Months of Inventory based on Closed Sales is 0, down 98.2% from the previous year.

The Average Sold Price per Square Footage was up 14.1% compared to previous month and up 55.9% compared to last year. The Median Sold Price increased by 25.4% from last month. The Average Sold Price also increased by 28.3% from last month. Based on the 6 month trend, the Average Sold Price trend is "Appreciating" and the Median Sold Price trend is "Appreciating".

The Average Days on Market showed a downward trend, a decrease of 85% compared to previous year. The ratio of Sold Price vs. Original List Price is 120%, an increase of 20% compared to previous year.

It is a Seller's Market

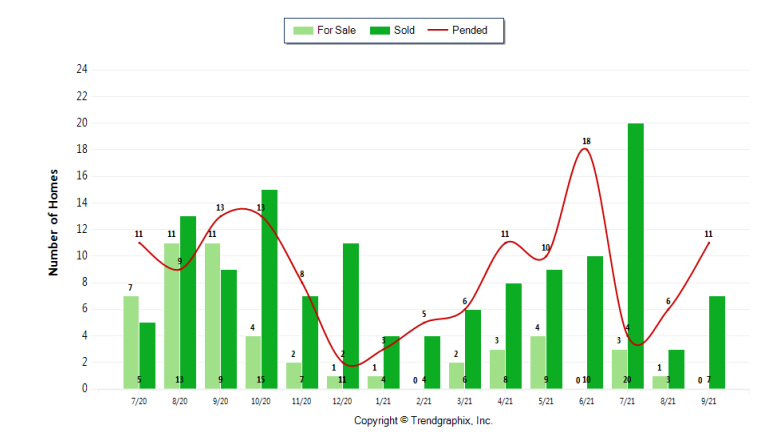

Property Sales (Sold)

September property sales were 7, down 22.2% from 9 in September of 2020 and 133.3% higher than the 3 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 11 units of 100%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventoryis down 100% compared to the previous month

Property Under Contract (Pended)

There was an increase of 83.3% in the pended properties in September, with 11properties versus 6 last month. This month's pended property sales were 15.4% lower than at this time last year.

September's housing market remained "very active" to "frenzied" around Washington state with brokers reporting year-over-year (YOY) gains in new listings, closed sales, and prices. Brokers with Northwest Multiple Listing Service also detected growing stability in the condominium market.

Historically low interest rates continue to drive the real estate market. Pent-up buyer demand, job and lifestyle changes, and inventory shortages are cited as factors contributing to a "very active market."

A new report from Northwest MLS shows brokers added slightly more new listings last month (11,373) than a year ago (11,210). That volume, which includes single-family homes and condominiums, nearly matched the total for August (11,437), and barely outgained the number of pending sales (11,318) for the 26 counties in the report.

Compared to the same month a year ago, pending sales slipped about 6% (11,318 versus 12,053). Despite that drop, the number of mutually accepted offers in the Puget Sound region (King, Kitsap, Pierce and Snohomish counties) made last month the MLS' second-best September, based on records going back to 2003. Last year's 4-county total of 8,606 pending sales is the highest volume for that timeframe spanning nearly two decades.

The housing market intensity for each new listing will continue its upward trajectory as the first of the year approaches.

Low inventory continues to pose challenges for buyers. At month end, Northwest MLS members reported 7,757 total active listings system-wide. That marked a slight improvement from August when there were 7,425 active listings, but it was a drop of nearly 14.8% from twelve months ago.

As of the end of September, there was about three weeks of supply (0.75 months), slightly better than August (0.70 months), but less than the same month a year ago (0.89 months). There has not been more than one month of supply since July 2020 when it reached 1.04 months.

Figures for single-family homes only (excluding condominiums) were more encouraging. Inventory declined only about 4% from a year ago. Seventeen counties reported YOY gains, with two others unchanged from year-ago levels.

King County, one of the exceptions, had the sharpest decline in inventory for single-family homes. The selection of single-family homes plummeted from the year-ago volume of 2,420 to 1,634 (down 32.5%).

For all counties in the report, the months of supply for the single-family component was the same as the figure for single-family homes and condos combined (0.75, or about three weeks).

While one could expect months of supply to increase around the end of the summer, shortage of supply still remains a significant issue, indicating demand still exists in many submarkets.

Strong price increases in nearly every "outer suburban" county along I-5 plus Kittitas County with prices in King County is a contrast. Nearly all of the outlying counties posted YOY increases at or above 15%, while King County experienced only a single digit gain of 6.7%. Prices in Kittitas County, where destinations like Suncadia and Ellensburg are within a two-hour drive to Seattle, surged more than 26% from a year ago.

With decreases in active listings in King and Snohomish counties, price pressure may increase in urban areas of the region as people return to the city for work," suggested Young.

One option for those wanting to live near urban job centers in anticipation of workplace reopenings may be condos.

The Seattle-area condominium market, which was negatively impacted by COVID-19, has stabilized, reporting consistent increases in both sales and prices.

Condo inventory, however, is sparse, with the selection at about half the year-ago levels (1,078 active listings at month end versus the year-ago supply of 2,129 listings).

In King County, Northwest MLS figures for September show a 20% jump in the number of condos that closed during September compared to a year ago; within the Seattle map areas, closed sales were up more than 34%. (King County currently accounts for about 70% of condo inventory and 60% of condo closed sales.) Condo prices rose more than 8% countywide, with the Southwest and Southeast and North King areas of the county registering the strongest gains at more than 13.5% in all three sub-areas.

Condo prices in nearby counties outgained the rate in King County, as did prices system-wide, which rose 15.7% from a year ago. Kitsap prices spiked 28.5%, Snohomish prices were up 17.8% and Pierce County condo prices jumped about 16.7%.

In addition to noting improvements in the condo sector, migration of buyers to suburban markets is continuing which has resulted in significant year-over-year price growth in areas such as Shoreline, Lake Sammamish, Auburn, Skyway, Woodinville, and Burien. It's likely that buyers are drawn to these areas because housing is more affordable than in the urban neighborhoods closer to Seattle and Bellevue.

According to NWMLS data, a single-family home that sold in King County last month had a median selling price of $825,600, while for condos it was $466,501. This further reflects the affordability crisis in our region as residential buyers are driven to the condo market.

One positive note for buyers is that prices are beginning to level out and the annual trend of the market slowing down as we move into the holidays remains. Buyers should consider staying in the market, if they can, as homeowners who are selling in the last quarter of the year tend to be highly motivated. Buyers will find less competition this time of year due to inclement weather and holiday travel.

Rising concern among sellers over legislation affecting capital gains rates is detected. With legislation in the queue on the national front that could cause an increase in capital gains rates, many sellers who have been on the fence about selling are now concerned they could lose profit in their homes to taxes if they wait. Also noted are some buyers that are backing away from bidding wars, instead choosing to wait for the right property.

The market as described as "brutal and unforgiving for buyers and sellers," with dreams being crushed on all sides. Buyers are swallowing hard and paying prices they curse, while sellers are having to move somewhere they hadn't originally planned - be that good or bad.

While inventory in some NWMLS counties appears to be improving, there are "still slim pickings," which portends escalating prices and fierce competition among buyers.

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Advice, please tune in to our Facebook live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com